Sep 14, 2005

piggy banks

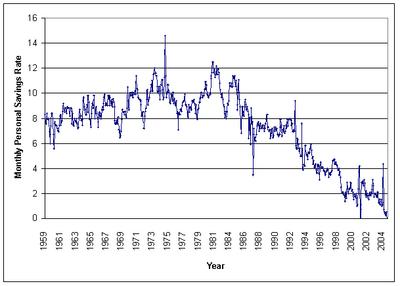

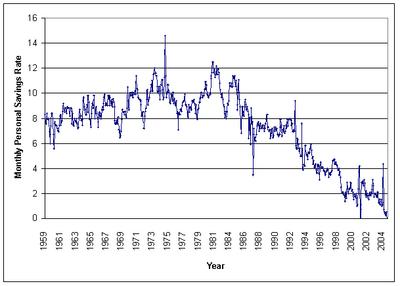

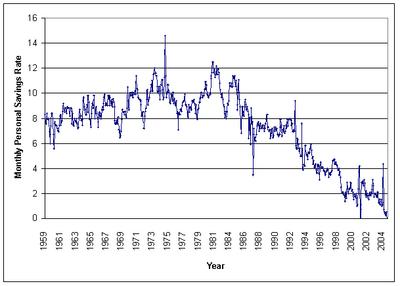

A few of the sites I read are talking about the U.S. savings rate today. I decided to go look at the data they were using myself. Savings rates are defined as total personal income minus total personal consumption over income. So spending a lot of money on your mortgage doesn't count. It's an amazing set of data. Not only because we are at zero savings rate but also because the trendlines change only over massive timescales. I would have though that 4 years ago or back in 1987 we would be saving a lot (after the market crashes). But that is not the case. Spending seems to be more related to some collective personality of the U.S. that has slowly changed over time. We have gone from a saving nation up until the mid 80s to an increasingly consuming nation ever since. Along the way we've used stock market asset increases and housing asset increase to fund this spending. But we are now at a limit that now requires us to borrow against our future earnings or our net current assets. Given the long time frames to change behavior it's not like we will be able to stop this increased consumption any time soon.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment